The financial debacle we’ve all been plunged into was brought about by two bubbles: the real estate bubble and the associated credit bubble. A choreography of fiscal lunacy is well summarized in a New York Times article by Michael Lewis and David Einhorn:1

“A deeper absence, inside our financial system, has been undermined not merely by bad behavior but by the lack of checks and balances to discourage it. ‘Greed’ doesn’t cut it as a satisfying explanation for the current financial crisis. Greed was necessary but insufficient; in any case, we are as likely to eliminate greed from our national character as we are lust and envy. The fixable problem isn’t the greed of the few but the misaligned interests of the many…

“And here’s the most incredible thing of all: 18 months into the most spectacular man-made financial calamity in modern experience, nothing has been done to change that, or any of the other bad incentives that led us here in the first place. Say what you will about our government’s approach to the financial crisis, you cannot accuse it of wasting its energy being consistent or trying to win over the masses. In the past year there have been at least seven different bailouts, and six different strategies. And none of them seem to have pleased anyone except a handful of financiers…

“In the middle of all this, Treasury Secretary Henry M. Paulson Jr. persuaded Congress that he needed $700 billion to buy distressed assets from banks—telling the senators and representatives that if they didn’t give him the money the stock market would collapse. Once handed the money, he abandoned his promised strategy, and instead of buying assets at market prices, began to overpay for preferred stocks in the banks themselves. Which is to say that he essentially began giving away billions of dollars to Citigroup, Morgan Stanley, Goldman Sachs and a few others unnaturally selected for survival. The stock market fell anyway...

“It’s hard to know what Mr. Paulson was thinking as he never really had to explain himself, at least not in public. But the general idea appears to be that if you give the banks capital they will in turn use it to make loans in order to stimulate the economy. Never mind that if you want banks to make smart, prudent loans, you probably shouldn’t give money to bankers who sunk themselves by making a lot of stupid, imprudent ones.”

It is also most disturbing to discover that this vulnerability was known and predicted, but attempts to forestall disaster were blocked by corrupt politicians who were “on the take” for the past 30 years. It all began with the passing of the Community Reinvestment Act of 1977, in which Fannie Mae and Freddie Mac were directed to subsidize subprime loans.

The mounting calamity from encouraging unsound lending practices was recognized by numerous members of Congress over several administrations, but attempts to repair the impending disaster were blocked by entrenched Democrats: specifically, by Barney Frank, Chairman of the House Financial Services Committee; Christopher Dodd, Chairman of the Senate Banking Committee; and their associates, who were the beneficiaries of bribes from the resulting gravy train.

The resulting real estate bubble of unsound loans, however, was only the tip of the proverbial iceberg.

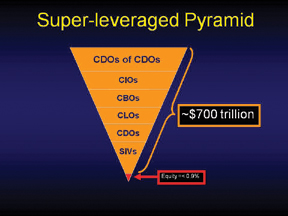

Securitization Leverage (“Derivatives”)

Wall Street developed a series of “Structured Investment Vehicles” (SIVs), with which funds could borrow money by issuing short-term securities at low interest and then lend them by buying long-term securities at higher interest, profiting from the difference. (However, these can become insolvent when the value of the long-term security falls below the value of the short-term security that was sold.)

SIVs became extremely profitable products among the institutional investment community; however, they were sold without regulation—no listing on public exchanges, no standards, no open market (bid/asked, etc.), no clearing houses—simply private contract arrangements, unfunded with no guarantees. Specific performance was dependent on the balance sheet of the loser.

It now appears that over $20 trillion in notional value are in default. And it gets worse.

Collateralized Debt Obligations (CDOs)

SIVs led to loans being repackaged as securities. First issued in the 1980s, these became the fastest growing sector of asset-based synthetic securities market, and are held by thousands of the largest financial institutions of the world. There are dozens of varieties which almost defy categorization:

- Collateralized Loan Obligations (CLOs) Backed by leveraged bank loans

- Structured Finance CDOs (SF CDOs) Backed by mortgage-backed securities

- Commercial Real Estate CDOs Backed by commercial real estate assets

- Collateralized Bond Obligations (CBOs) Backed primarily by corporate bonds

- Collateralized Insurance Obligations (CIOs) Backed by insurance or reinsurance contracts

- Credit Default Swaps (CDSs) $14.9 trillion to $45.5 trillion (300%) in 12 months

- CDOs backed by groups of other CDOs

Most of these bundled packages of subprime loans are now effectively worthless. They were based on the premise that markets would expand indefinitely and never contract. Their sales were completely unregulated and massively (fraudulently) overrated by the rating companies: Fitch, Moody’s, and S&P. False “Triple-A” Bond ratings were given by specialized default insurance companies: Ambac, MBIA, CIFG, and FGIC. Nine major insurers of over 80,000 corporate, municipals, and mortgage backed bonds are also in trouble and having their own credit ratings cut.

A sampling of exposures to these “derivatives”:2

- JP Morgan Chase $90.4 trillion

- Bank of America $38.1 trillion

- Citigroup $38.1 trillion

- Wachovia $4.9 trillion

- HSBC $4.4 trillion

- Wells Fargo $1.5 trillion

How Much Is a “Trillion”?

It’s easy to throw words around without a grasp of their significance. Each day we find increasing tax payer liabilities being added by various “bailout” programs and other spending sprees. How much is a trillion?

- It is the sum of all the government borrowing in the history of 42 administrations: from 1776 to 2000, the first 224 years of U.S. history, a total of $1.01 trillion was borrowed.

- If you were paid $1.00 per minute, 24 hours per day, 365 days per year, it would take 2 million years to collect $1,000,000,000,000.

Derivative Exposure

The total exposure from the collapse of derivatives eludes even the experts in this field. Some of the published estimates are literally beyond our grasp and are on an equity base of less than 1%!

The total exposure from the collapse of derivatives eludes even the experts in this field. Some of the published estimates are literally beyond our grasp and are on an equity base of less than 1%!

- U.S. Government Bailouts

- TARP $700 billion, and growing

- Bear Stearns $29 billion

- Detroit Big Three $25 billion

- AIG $123 billion

- Fannie and Freddie $200 billion

- Mortgage-backed Securities $144 billion

- FHA Rescue bill $300 billion

- JPM for Lehman $87 billion

- Fed’s TAF program $200 billion

- Commercial paper $30 billion

- Fed currency swaps $740 billion

- TOTAL $2,700 billion ...so far

FDIC

Many naïve investors take comfort in the fact that their bank deposits are insured by the Federal Deposit Insurance Corporation (FDIC). The FDIC is the insurer of $13.3 trillion in U.S. bank deposits in 8,451 U.S. Banks. However, it had less than $35 billion in insurance funds at the end of the 3rd Quarter 2008 (down 24%). That amounts to only 76 cents for every $100 of insured deposits; less than 1%. For example, how can the FDIC participate in the GE Capital loan guarantee of $139 billion? This amounts to simple cosmetics to help defer bank runs.

A Structural Revolution in Progress

We occasionally hear the word “fascism” without really understanding its meaning: Webster’s Dictionary cites it as follows: “Any program for setting up a centralized autocratic national regime exercising the regimentation of industry, commerce, and finance, rigid censorship and forcible suppression of opposition.”3

As we watch—daily—our traditional institutions become nationalized, and we watch our politicians saddle our children and grandchildren with debts beyond any capacity to ever be repaid, we need to prayerfully reflect on the implications for our future, our liberties, our freedom of worship, and our priorities. Let Psalm 91 be your devotional commitment in these turbulent hours

Notes:

- Michael Lewis and David Einhorn, “The End of the Financial World As We Know it,” New York Times, January 4, 2009.

- FDIC/IRA Bank Monitor, Q1 2008.

- Webster’s Third New International Dictionary (Unabridged).