In the not-too-distant future, wars will be fought over natural resources. Last year China consumed nearly half of the world's cement, 2/3 of total world consumption of copper, nearly 1/3 of the world's coal, and 90% of the world's steel (plus huge quantities of nearly every other commodity).

And now China trails only America as the greatest consumer of oil. Fifty years ago, America was producing half the world's oil supply and today we can't produce even half of our own needs. The United States - 5% of the global population - consumes 25% of the world's total oil supply.

Today, one new barrel of oil is found (worldwide) for every six barrels we (the world) consume. According to Bill O'Grady, respected analyst for AG Edwards, the world needs to find another 40 million barrels of oil a day on top of what's currently being produced to meet demand in 2010 - which is only five years away. And that seems highly unlikely to the industry analysts.

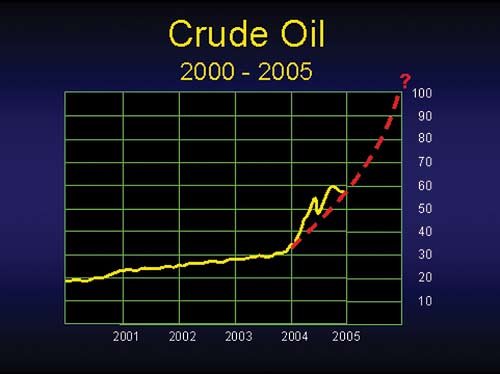

We are now entering the era of $50+/barrel of oil and $7+ natural gas. The average price for a barrel of crude in the 1990s was $15.65. Today, that same barrel of oil costs over $50! In the UK today, petrol costs well over US$5/gallon.

Global Oil Production Peak

The term "global oil production peak" means that a turning point will soon arrive when the world will produce its absolute highest one-year maximum crude - after that, yearly production will inexorably decline. Today, with global consumption nearing the 84 million barrel/day mark, most analysts agree that the peak will hit sometime this decade. Some believe it is already here. As it was in Daniel 5, "the handwriting is on the wall."

The U.S. reached peak oil production 35 years ago. Today our lower 48 states are producing less than half of what they used to. If the U.S. were forced to rely on its own resources, it would run out of oil in four years and three months. (And this takes into account the Strategic Petroleum Reserve, created in 1975 and located at a number of sites in Texas and Louisiana.)

Norway's North Sea, a prolific oil region twenty years ago, is now in steep decline. Libya's oil production peaked in 1970. Iran topped out in 1974; Indonesia, in 1997. Europe, as a whole, peaked in 2000.

The "oil peak" is the halfway point in the worlds total supply: the point at which only half the worlds oil is left. But the easily extracted oil is now behind us; the second half will prove more costly to get out of the ground.

The Energy Information Administration projects that, in just 15 years, the United States will require about 50% more natural gas and 33% more oil to meet escalating demand.

Goldman Sachs Report, March 2005, stated the following: "We believe the oil markets may have entered the early stages of a super spike period, which we now think can drive oil toward $105 per barrel."1

But the current crisis has less to do with U.S. consumption and more to do with global trends. Fueled primarily by the developing economics of east and south Asia and the Pacific region, worldwide oil demand will continue to rise, and prices will continue to escalate.

Sources of Supply

Most of the vast majority of remaining conventional reserves are located in highly unstable regions of the world, such as the Middle East, Russia, Africa and South America.

Saudi Arabia holds just over 1/4 of the world's oil reserves at 264 billion barrels. (All of Saudi Arabia's big fields were discovered in the 1950s.) As the world's largest oil producer, the Saudis pump roughly 10 million barrels of oil per day.

(However, they are also dealing with nearly three million barrels of water per day. Matthew Simmons, chairman of Simmons & Co., says that old wells that hold a 40% water content are "almost dead." Officially, the Saudis admit they are up to nearly 30% water content. Are they telling the truth? Or is the world's most important oil reserve on the verge of collapse?)

China will eclipse U.S. consumption in twenty years or less, and there's not enough oil to feed two superpowers. China has now leapfrogged Japan to become the world's second-largest oil user. China is making long-term oil deals in top exporting countries, including Saudi Arabia, Russia, Nigeria, Sudan, and Canada. They are desperate.

China has the world's fastest growing economy coupled with the world's largest population. They are preparing for the influx of some 300 million people into its urban areas - more than the entire population of the United States. China's recent prosperity has raised the living standards of 160 million Chinese who once existed in poverty. Behind them is another billion who are waiting their turn to live a life once thought to be unattainable.

The same can be said of India. With a nearly 24% increase in car sales in 2004, India is now the fastest-growing car market in the world, outstripping China's 13% growth last year. Goldman Sachs projects that India will have the largest number of cars by 2050, and India is already a net importer of crude at nearly 2 million barrels per day.

It may surprise you to learn that Canada has the second-highest energy reserves in the world, right behind Saudi Arabia. Canada has more oil and gas than Iraq, Iran, or Kuwait. The U.S. Department of Energy believes that Alberta has 174 billion barrels of economically extractable oil equivalent. Canada produces 2.6 million barrels of oil per day and exports most of it to the United States. The province of Alberta contains 80% of that energy. Alberta is also the world's largest exporter of natural gas to the United States.

Natural Gas

Crude oil dominates our transportation sector; natural gas dominates our electricity generation and U.S. industry sectors. Ninety percent of all new power plants slated to come online in the next 15 years will run on natural gas.

The price of natural gas, at current levels of around $7/mcf (thousand cubic feet), is already 250% higher than it was in 2000. It could be $15/ mcf within two years! Current U.S. demand stands at around 23 tcf (trillion cubic feet) per year. The Energy Information Administration expects that figure to catapult to 34 tcf by 2020. That's a serious demand spike of nearly 50% in less than 15 years.

The U.S. possesses only 35 of the world's known natural gas reserves. Domestic production has run into a brick wall at around 19 tcf per year. That leaves an annual 17% shortfall of around four trillion cubic feet that must be made up through imports.

Chinese Trading Partnership

In 2002, America purchased 10% of China's entire GDP while China purchased one-fifth of 1% of ours. We bought 40% of China's exports. China bought about 3% of ours.

Our primary export is our jobs. We are transferring our production capacity to China and other Asian countries.

China ran up their trade surpluses on sophisticated industrial goods. Among the 23 items in which America had a trade surplus were agricultural goods and commodities. It is disturbing to discover that the U.S. has the export profile of a 19th century third world economy!2

Trade Imbalance

Since 1990, foreigners have acquired $3.6 trillion of U.S. assets as a result of the U.S. trade deficit. The U.S. trade imbalance is now approaching an annualized $900 billion. But why, then, isn't the U.S. dollar collapsing? Because China is aggressively buying U.S. dollars in order to keep the dollar overvalued against its own currency, the renimbi. In this way, the Chinese can continue to sell the U.S. their goods in enormous quantities and keep their expanding population employed - and continue to build their country's infrastructure.

China currently needs to accumulate $2 billion per day. By printing more of their own currencies, their accumulation of dollars has been directed toward buying U.S. Treasuries, which props up the bond market and keeps the interest rates down. This is one of the factors supporting our real estate market and converting us to the bubble of an "asset-based" economy - by simply refinancing ostensible asset appreciation rather than real organic productivity improvement.

The equity extraction from ever-rising property appreciation is being viewed as a substitute for real sources of labor income generation and pressures consumers to go deeply into debt to monetize their windfall. Household sector indebtedness has now surged to 90% of the U.S. GDP: an all-time record, up 20% from the levels of the mid-1990s. Not surprisingly, our personal saving rate is virtually zero.

There are those who fear the ultimate effects of an even modest decline in the foreign accumulation of our debt would cause this "asset-based" bubble to burst.

(The ultimate adjustments from our asset-based economy will be the subject of another article.)

The Moving Finger Moves On

The centroid of power, which started in the cradle of civilization - the Middle East - migrated westward through the ancient empires - Babylonian, Persian, Greek, and Roman - through northern Europe in the 16th and 17th centuries, then westward to America. The 20th century was, indeed, as Henry Luce dubbed it, the "American Century." It seems apparent to most analysts that the 21st century will be the "Asian Century."

But the centroid is destined to keep moving westward:

Saying to the sixth angel which had the trumpet, Loose the four angels which are bound in the great river Euphrates. And the four angels were loosed, which were prepared for an hour, and a day, and a month, and a year, for to slay the third part of men.3

And again:

And the sixth angel poured out his bowl upon the great river Euphrates; and the water thereof was dried up, that the way of the kings of the east might be prepared.4

The final world empire will ultimately be established right where it all began. Indeed, the King is coming! Maranatha!

Notes:

- Goldman Sachs, New Industry Perspective, March 30, 2005.

- Pat Buchanan, Where the Right Went Wrong.

- Revelation 9:14-15.

- Revelation 16:12.